The Importance of Fraud Management System and the ROC-Fraud Management System

- Introduction

Fraud Management System is the set of technological tools and strategies that businesses use to detect, prevent and respond to fraud attempts. These systems are designed to reduce financial losses, preserve customer trust and maintain the reputation of the business. Fraud management systems, which find a wide range of applications in various sectors such as banking, e-commerce, telecommunications and healthcare, are vital for companies in the face of increasing cyber threats. This article will focus on the importance of fraud management systems, how they work and the advantages they provide.

- Importance of Fraud Management System

With the rise of digitalization, methods of committing fraud have become more sophisticated and pose a major risk to businesses. Fraud can not only lead to financial losses, but also undermine customer trust and damage the brand value of the business. Fraud management systems play a critical role in proactively managing these threats and keeping businesses safe.

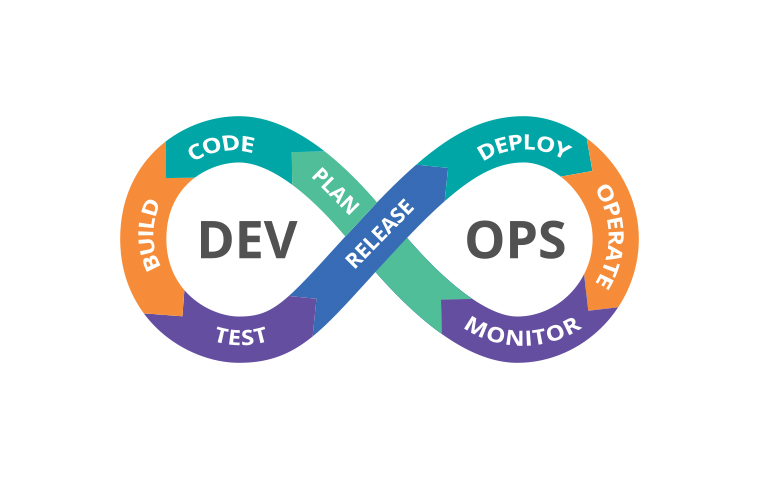

- Working Principle of Fraud Management Systems

Fraud management systems typically include the following components:

- Detection of Anomalies: Detects abnormal behavior and patterns in transactions. This is usually done using machine learning and artificial intelligence technologies.

- Risk Assessment: Calculates a risk score for each detected transaction and identifies potential fraud attempts.

- Warning Systems: When high-risk transactions are identified, the system automatically sends alerts and enables the relevant teams to intervene quickly.

- Rule Based Filters: Filters and classifies transactions based on predetermined rule sets set by the business.

- ntervention and Remediation: When fraud attempts are detected, the system can automatically intervene or make referrals for human intervention.

- Advantages

- Reducing Financial Losses: Prevent significant financial losses by detecting fraud attempts at an early stage.

- Protecting Customer Trust: Increases customer trust and satisfaction by protecting customers' accounts and data.

- Operational Efficiency: Thanks to automated alerts and interventions, anti-fraud processes become more efficient.

- Compliance and Reputation Management: Ensures compliance with laws and regulations and protects the reputation of the business, avoiding potential legal sanctions.

5.Conlusion

Fraud management systems are a must-have security measure for modern businesses. They help businesses maintain financial and operational health by providing a proactive line of defense against fraud threats. With the integration of advanced technologies such as artificial intelligence and machine learning, fraud management systems are becoming increasingly effective and sophisticated, enabling businesses to stay one step ahead of these threats.

ROC-Fraud Management System

ROC (Revenue Operations Center) Fraud Management System is an advanced technological solution from Subex Limited, an India-based telecom artificial intelligence company operating since 1992, used to detect, prevent and manage fraudulent activities that lead to revenue loss in the telecommunications industry, financial services, e-commerce and other digital businesses. The system provides proactive protection against fraud attempts using modern technologies such as big data analytics, artificial intelligence (AI), machine learning (ML) and real-time transaction analysis. The main objective of the ROC Fraud Management System is to minimize fraud risks to protect businesses' revenues, improve operational efficiency and ensure customer trust. This article will detail the operation, importance and advantages of the ROC Fraud Management System.

ROC- How Fraud Management System Works

ROC Fraud Management System operates based on the following core functionalities:

- Data Collection and Integration: Collects and integrates data from various sources. This data can be from customer transactions, user behavior, network data and other relevant sources.

- Anomaly Detection: Detects abnormal behavior and signs of potential fraud using machine learning and artificial intelligence models.

- Risk Assessment: Calculates a risk score for each identified transaction or behavior and identifies transactions classified as high risk.

- Alert and Response: When it detects potential fraudulent activity, the system sends automatic alerts, enabling rapid intervention and halting or blocking transactions if necessary,.

- Continuous Learning: As fraud methods are constantly evolving, the system constantly learns and updates itself with new data to improve anti-fraud strategies.

Importance

With the growth of the digital economy, fraudulent activities have increased and become more complex. ROC Fraud Management System provides businesses with the following advantages:

- Prevention of Financial Losses: Protects the revenues of businesses by preventing financial losses that may occur through fraudulent activities.

- Increasing Customer Trust: Increases customer satisfaction and trust by effectively preventing fraud attempts against customer accounts.

- Compliance and Reputation Protection: Protects the reputation of the business by ensuring compliance with regulatory requirements and reducing incidents of fraud.

- Increased Operational Efficiency: Reduces the amount of time and resources spent in the fight against fraud through automated detection and response mechanisms.

Benefits Provided

ROC Fraud Management System offers significant advantages to businesses by providing high accuracy in fraud detection and low false positive rate in high volume and complex transaction environments. With real-time analysis and response capabilities, these systems strengthen businesses' anti-fraud strategies, prevent revenue loss and improve the customer experience. The ROC Fraud Management System is an indispensable component in the anti-fraud toolkit of modern businesses. Using technological advances, it provides proactive protection against fraud risks, protects businesses' revenues and supports sustainable growth. The integration of these systems allows businesses to become more resilient to fraud and move forward safely on their digital transformation journey.

REFERENCES

- Mohapatra, Debasis (9 January 2019). "Subex launches CrunchMetrics, forays into fintech, retail and e-commerce". Business Standard. Retrieved 14 October 2020.

- Yash Mohan (24 August 2024). https://www.linkedin.com/pulse/future-revenue-assurance-fraud-management-telecom-yash-mohan/

- Christopher, Nilesh (14 November 2018). "Subex sets eyes on IoT security business, says it is on growth path". The Economic Times. Retrieved 14 October 2020

- Fraud Management (2024). https://www.subex.com/fraud-management/

- VoIP Fraud List, http://www.voipfraud.net/

- https://seon.io/resources/top-fraud-management-systems-how-to-pick-one/

- Becker, R. A., Volinsky, C., and Wilks, A. R. (2010), “Fraud Detection in Telecommunications”